In transactions made through decentralized exchanges (DEX), the typical third party entities which would normally oversee the security and transfer of assets (e.g. banks, stockbrokers, online payment gateways, government institutions, etc.) are substituted by a blockchain or distributed ledger.

In contrast to centralized exchanges (CEXs), decentralized platforms are non-custodial, meaning a user remains in control of their private keys when transacting on a DEX platform. In the absence of a central authority, DEXs employ smart contracts

Because users do not need to transfer their assets to the exchange, decentralized exchanges reduce the risk of theft from hacking of exchanges. Decentralized exchanges can also prevent price manipulation or faked trading volume through wash trading, and are more anonymous than exchanges which implement know your customer (KYC) requirements.

Decentralized exchanges (DEXs) have emerged as an alternative to CEX platforms (centralized exchanges), offering peer-to-peer (P2P) trading and access to the emerging sector of decentralized finance (DeFi)

Although centralized exchanges still dominate crypto markets and serve the needs of everyday crypto traders and investors, decentralized exchanges provide an interesting alternative. Through on-chain smart contracts, DEXs provide a trustless method of connecting buyers and sellers, and are offering new models of equitable involvement and governance for stakeholders.

I believe the role of the government is too big. Society must be more decentralized.

Check out these

Complementary products

How to DeFi: Advanced

at the time of publication

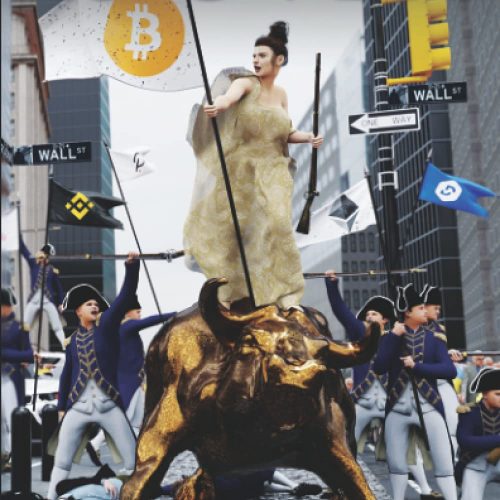

The Wall Street Era is Over

at the time of publication

Graphic Novelty T-Shirt

at the time of publication