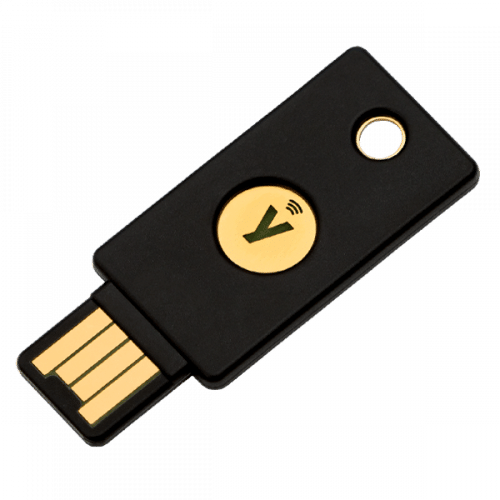

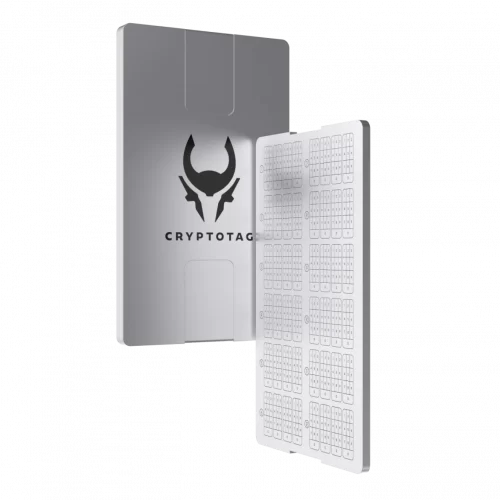

There are different kinds of self-custody solutions that vary in their security and ease of use. You can learn more about cold storage

There are risks to storing one’s crypto coins & tokens on a centralized exchange, including counterparty risk, the risk that the exchange would be hacked and your Bitcoin would be stolen, and the risk of rehypothecation.

When one owns crypto, they own a public key

The unique combination of your private keys and your public wallet address is what gives you access and therefore the ability to manage and trade coins.

Your private keys are the equivalent of your password. Private keys can be generated and stored in two ways: either on a device separate from the wallet provider’s server system or stored on a wallet provider’s server so that the provider can transact on the blockchain on your behalf.

These two types of storage wallets are called non-custodial (or self-custody) wallets and custodial (or hosted) wallets.

When your private keys are generated and stored away from the wallet provider’s system, those private keys are known to and accessible only by you.

Self-custody wallets are designed to keep you in control of your private keys without the need for an institutional intermediary. You are in control.

True cryptocurrency ownership means maintaining self-custody so that you have constant access to your funds and control of your private keys.

If another person has access to your private keys, they can spend the crypto in your wallet. To protect your crypto, you have to ensure that no other person can access your private keys, except in the case of inheritance.

Why is self-custody important?

Owning your crypto private keys allows you the power to enjoy the full benefits. You do not need any permission to store, send, and receive crypto. With self-custody, there are no know-your-customer (KYC) requirements, and you can transact your crypto pseudonymously.

If you decide to keep your crypto on an exchange, you run the risk of being held hostage by the government or the exchange. Some exchanges can freeze your crypto transactions, set limits on the amount you can transact, and even use your deposits to back up their exposures.

In the world of cryptocurrency, true ownership is defined by access and control.

Secure your crypto. Secure your future.

Distrust and caution are the parents of security.

Check out these

Complementary products